New & Used Vehicle Loans

Shopping for a new vehicle?

With our Member Rewards and Pre-Approval programs your choice is as easy as 1-2-3!!

We also offer:

- Minimum monthly payments: $50

- No prepayment penalty

- Joint life and disability payment protection insurance plans are available

- Activity appears on your regular statement

- Flexible methods of repayment include payroll deduction/direct deposit, automatic transfer from another SeaComm FCU account, through Enhanced SmartLine audio response or Access Digital

Cars, Trucks1, and Vans

- For new vehicles, 100% financing is available, including taxes, warranties and options

- For used vehicles, 100% financing is available for vehicles under 3 years old, including taxes, or up to 110% of the retail NADA value (whichever is less)

- The maximum repayment is 7 years for fixed rate loans (Some restrictions may apply)

Do you answer “YES” to any of these questions?

- Are you getting sticker shock while shopping for a new or used vehicle?

- Are you “lowering your standards” to get the vehicle payment you want?

- Is buying less than what you really want the solution?

- Do you have a “dream vehicle” you think you can’t afford?

STOP DREAMING....we have the solution for you!

The DrivingSense™ vehicle financing program will put you behind the wheel of that new or used car, van or light truck you want with a monthly payment you can afford. Like a lease, DrivingSense™ offers monthly payments that are considerably lower than conventional financing. But, unlike leasing, with DrivingSense™ financing, you own the vehicle without all the hassle or hidden costs associated with leasing! All current year and previous model cars, vans and light trucks (up to five years used) qualify.

For more information about DrivingSense™, call or visit any one of our convenient SeaComm locations today, or use the DrivingSense™ calculator below to see for yourself how low your vehicle loan payment will be......You’ll love it!

Discover the advantages of DrivingSense™ for yourself!

Vehicle loan protection for what your auto insurance may not cover for a wrecked vehicle.

That’s where Guaranteed Asset Protection (GAP) comes in.

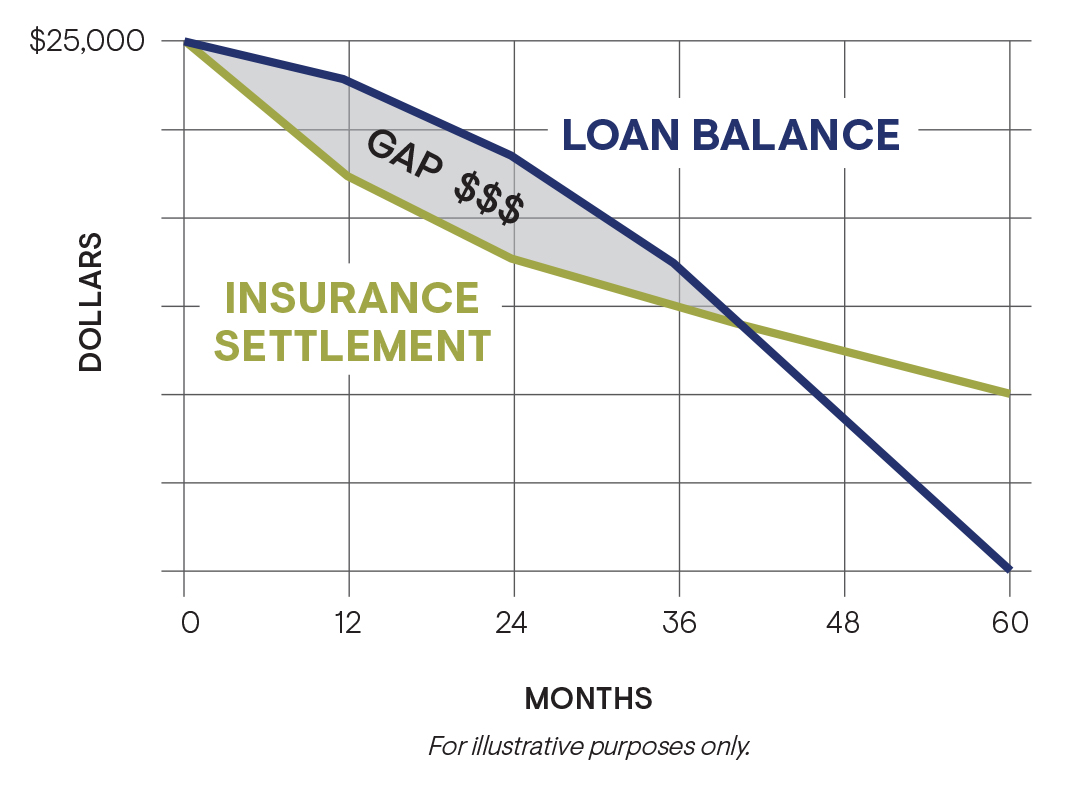

If your vehicle is deemed a total loss due to an accident or stolen, there can be a significant gap between what you owe on your loan and what your auto insurance will cover. GAP may reduce or even eliminate that shortfall in the event your vehicle is deemed a total loss.

Essential financial protection on your vehicle loan that helps you drive with confidence. Talk to SeaComm today about how we can help protect you from sudden out-of-pocket expenses with Guaranteed Asset Protection.

Fair market insurance value isn't always fair. There may be a gap.

Protect your vehicle loan - purchase GAP today!

Your purchase of MEMBERS CHOICETM Guaranteed Asset Protection (GAP) is optional and will not affect your loan application for credit or the terms of any credit agreement you have with us. Certain eligibility requirements, conditions, and exclusions may apply. You will receive the contract before you are required to pay for GAP. You should carefully read the contract for a full explanation of the terms. If you choose GAP, adding the GAP fee to your loan amount will increase the cost of GAP. You may cancel GAP at any time. If you cancel GAP within 90 days you will receive a full refund of any fee paid.

GAP purchase from state chartered credit unions in FL, GA, IA, UT, VT, and WI, may be with or without a refund provision. Prices of the refundable and non-refundable products are likely to differ. If you choose a refundable product, you may cancel at any time during the loan and receive a refund of the unearned fee.

GAP purchase from state chartered credit unions in CO, MO, or SC may be canceled at any time during the loan and receive a refund of the unearned fee.

GAP purchase from state chartered credit unions in IN may be without a refund provision. If the credit union offers a refund provision, you may cancel at any time during the loan and receive a refund of the unearned fee.

GAP-3414653.2-0722-0824 CUNA Mutual Group ©2022, All Rights Reserved.

11 ton & under